Industries

Banking And Financial Institutions

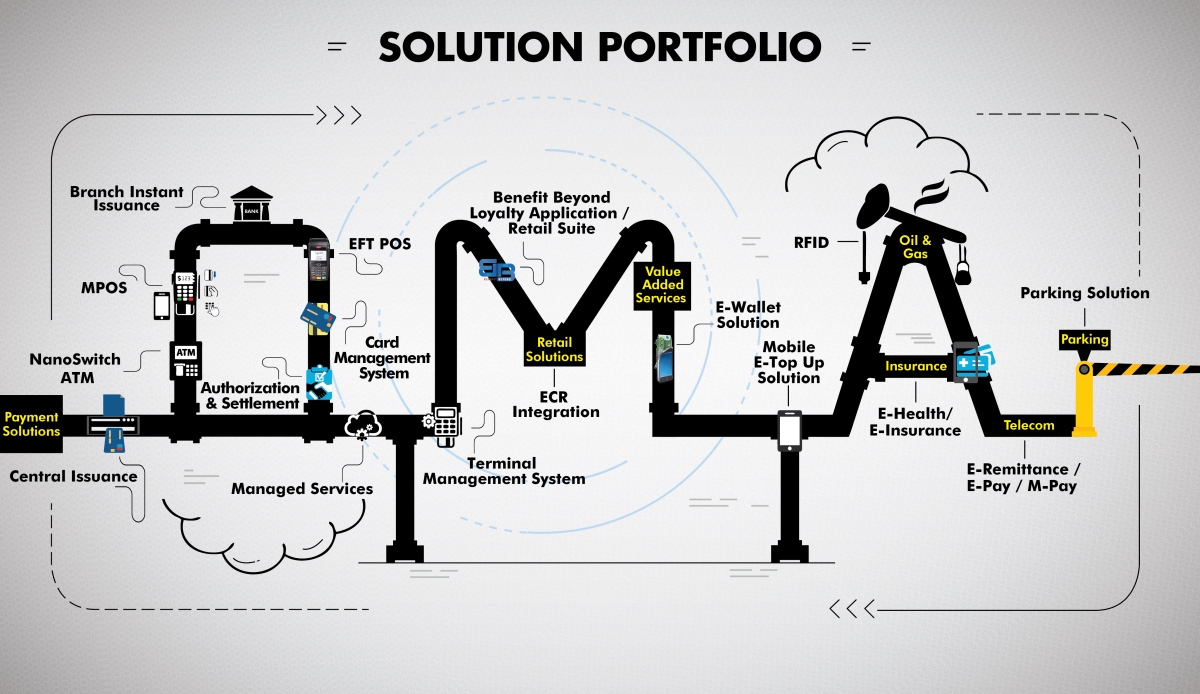

Central Issuance : OMA Emirates provides complete solutions for personalization and post-issuance management of single and multi-application smart cards where information gathered from a number of locations are collected at a central point along with personalization and development for distribution to the cardholders. Our central issuance solution allows banks to take full control of the issuance through in house personalization supporting multiple databases and allowing data retrieval, image capture, card issuance and reporting facilities. Read More

Branch Instant Issuance : The branch issuance solution enables EMV compliant smart card issuance instantly from bank branches following successful registration as well as instant replacement of lost or stolen cards in less than one minute. Being EMV compliant also means that high security levels are ensured through encryption using key management schemes (Master Session, DUPKT and RTKS) and EMV data remains in the central server accessed only by authorized bank staff upon request. OMA Emirates' secure pin pad can be used to allow card holders to enter their pin or alternatively an IVR can be used. Read More

MPOS : Retailers are now seriously considering mobile POS solutions to address challenges and opportunities in the new connected world. OMA Emirates help merchants on the way from Channel to Customer eccentricity: Payments, CRM, Loyalty, Mobile and POS technology providers are extending their offerings to enable integrated shopping experience. Mobiswipe is the most convenient Mobile Payment Service that enables merchants to accept credit & debit card payments anywhere and anytime by using their android mobile or tablet loaded with the MobiSwipe Application that gets connected to EMV L1 & L2 PCI-PTS Certified Card Reader. Click link to know more: www.mobiswipe.in

EFT POS : OMA Emirates' EFT POS application processes all types of paymet cards through real-time authorization in a secure payment environment using key management systems such as Master/Session Key, Racal Transaction Key Scheme and Derived Unique Key interacting with any payment service provider. Certified by ADVT and TIP, it supports EMV cards and is able to perform multiple host routing. The fast paced deployment of private cards, gift cards and phone top-up cards ensures minimized transaction queues for users. Read More

NanoSwitch ATM : A secure online solution for ATM transactions optimizing the management of ATM activity providing transaction routing, authorization host, settlement and management reports. The solution complies with strict EMV standards and is certified by major payment labels including VISA and MasterCard. The monitoring system of NanoSwitch ATM allows in depth supervision of ATMs providing clients with detailed information on the ATM activities at any given moment with the number of ATMs in service, out of order, without connection and more. A measurement system generates analyses of each ATM performance using stored data and offers both standard and customized reporting capabilities which can be utilized at any time. Read More

Card Management System (CMS) : OMA Emirates' CMS can help you offer cutting-edge services and maintain the highest customer service levels. The CMS is a complete EMV certified system that manages both issuing and acquiring functions for private and international banking cards including card and merchant functionalities, payment authorization, account clearing and settlement. All approved authorizations can be controlled and monitored with the CMS and instant transaction reports can be generated demonstrating statistics for all transaction activity. Read More

NanoPerso : OMA Emirate provides EMV-NANOPERSO Card Personalization solutions that comply with strict EMV security and design standards ensured by host security module. The software contains magnetic stripe encoding and chip encoding as well as contact/contactless encoding. Read More

Authorization and Settlement : OMA Emirates' EMV Authorization Host determines whether a transaction is accepted, rejected or referred to a card authorization organization by card issuers such as VISA, MasterCard, and JCB etc. The approval process is based on account number validation in combination with an expiration date or authorization schemes such as hot card to ensure the cardholder's account is activated and that the card has passed various security checks and is activated when sales transactions are made in POS machines/devices. The system can be configured to a variety interfaces, ATM terminals, POS machines/devices, host systems, credit card networks and switch networks using customized authorization settings to determine the relevant authorization issuer and monitors card usage by product type, volume, time, location and usage limits if applicable. Read More

Managed Services : OMA Managed Services provides banks with onsite teams to manage Terminal and POS services, POS Network Services, ATMs, Remote IT Infrastructure and Digital Payment Solutions. The new OMA Managed Services has no ownership costs for banks and financial institutions and provides 24/7 skilled onsite or offsite manpower. It provides them with a cost effective alternative along with the benefits of smoother card production in order for the banks to achieve better customer satisfaction. Banks can now avail of the advanced technology to their full capacity with technical staff that provide services to the banks with PCI compliance standards. To know more click here www.omams.ae

Terminal Management System (TMS) : This is a flexible, easy to use system for Ingenico POS terminals that provides a full suite of facilities to control POS terminals and their software as well as allowing users to define, configure and update POS parameters and tasks. The TMS is also equipped with two auditing levels; the User Activity log which logs all users activities such as login/logout and screen access and the Audit Log which generates database level log report for all tables as well as a link to more detailed screen specifying the values for the updated fields before and after update. The TMS is comprised of three components : POS Master, Connection Services and Monitoring. Read More

Digital Banking Solution : OMA Emirates enhances its Digital Banking portfolio by introducing Instant Account Opening and Card Issuance Kiosk, Digital Wallet, QR Code Payment and Biometrics to provide hassle free and convenient banking services through alternate delivery channels to customer by leveraging technology. Read More

RETAIL

ECR Integration

OMA Emirates offers clients a unique user-friendly and secure integration tool that integrates various software and hardware components with EFTPOS residing on an IP-based LAN or wireless infrastructure enabling the management of external peripheral devices such display screens , printers and keyboards that may be required. The solution allows for automatic routing of transaction from user's POS terminal to the authorization server securely through the secure key management scheme by Pin Pad. The Pin Pad performs the Request and Response Block MAC calculation and verification and generated pin block while the ECR initiates the payment authorization request, sends the response back to the pin pad and finally generates a receipt.

Benefit Beyond

Benefit Beyond is a multi-loyalty scheme which has a redeeming model application available on every clients touch point. Benefit Beyond is a Business to Business to Consumer (B2B2C) program which would help collect and analyze a wide spectrum of customer data, such as customer information, transaction details, information about intermediaries (distributors, dealers, sales agents etc.), responses to marketing campaigns and promotions and many others. The program includes issuing Loyalty Cards, Prepaid Cards, Gift Cards and Retail Suite. To know more click here www.benefitbeyond.com

- Loyalty Application

B2B2C (Business to Business to Consumer) loyalty programs are a great way to encourage loyalty among your B2B clients and at the same time connect with your end customers. The uniqueness of this program is the fact that they encourage more sales and profitability, while providing effective means for reaching your end customers. This loyalty program will help businesses across a range of verticals and sizes to provide numerous benefits to customers. The greatest advantage is that customers can avail of points across multiple outlets including airlines, supermarkets, entertainments and many others. In addition customers are not restricted to redeeming points within the same store or chain of stores. This solution is built on the OMA Emirates network of terminals deployed in the market. - Retail Suite

OMA Retail Suite helps retailers using any CRM with customer data while linking its services and providing a mobile friendly application to work on social media. It reduces cost and improves profitability. It represents an ecosystem of web portals and Windows, Android application. It is a scalable and open platform with straightforward model for integration with leading ERP systems (SAP, Navision, Axapta, Oracle) which can be deployed on OMA Cloud or onsite.

OMA Interactive Shelf Label System (Digital Edge)

OMA Emirates’ ISL system is based on a wireless application protocol technology which can be widely used in any retail environment like hypermarkets, shopping malls, boutiques, chain of stores and others. The system is designed to replace the conventional paper labels in a digital form ensuring product details, specifications and pricing is accurate and updated frequently. The OMA Emirates ISL system can also reduce operational costs, optimize management flow of goods and add various features to the retail business management system. ISL has designed to interact with users, by showcasing correct prices and improves better efficiency of the store activity. The ISL is a battery powered electronic display system.

Value Added Services

E-Wallet Solution : OMA Emirates' new generation of E-wallet solutions supports all common sets of protocols for entering information into online forms and POS terminals agreed upon by all major players in the industry. It works with all web-security software as well as all POS terminals and enables E-wallets to automatically extract customer information into payment forms of participating merchants. Our E-wallet is stored on servers controlled by the bank or other service providers whose software manages the exchange of information with merchants' website and can stand alone or be integrated with existing financial products and networks.

View more Value Added Services

OIL AND GAS

OMA Petrol Solutions (OPS)

OMA Petrol Solutions, OPS specializes in end-to-end system solutions for the petrol industry including complete station automation, outdoor payment terminals and convenience store management. The OPS system includes advanced loyalty and digital payment solutions based on contactless vehicle identification. OMA Emirates works both directly and through its network of strategic world-class partners with a customer database including major pioneers in the industry throughout the Middle East and Africa. Read More

RFID

OMA Emirates is the ultimate answer to easy and secure RFID automated refueling based on a vehicle's identification device. By adding the OPS at petrol stations, dealers and oil companies, they offer an advanced service for fleets and private motorists. This also acts as a convenient and easy loyalty tool. OMA is an integral part of the Vehicle Identification, VID, station automation and can be incorporated simply through a small antenna reader attached to the nozzles for contactless reading of the FuelOpass device installed in the vehicle, however for the convenience of clients, the VID can also be integrated into other station automation systems, The OPS station infrastructure can also be used for tracking personnel activity and attendant shift management by reading the attendants contactless tags to authorize the pump for FuelOpass refueling. The system covers all the refueling stages including identifying the vehicle in need of fuel, releasing the pump according to the correct fuel type and logging the transaction.

INSURANCE

E-HEALTH

E-Health is changing the way providers can deliver improved Healthcare at reduced costs. It improves quality of care, reduces administrative and medical errors and provides a better patient experience. The e-Health revolution is now accelerating, offering more innovative connected solutions at the point of care with Healthcare providers getting remote and real-time access to patient information (Electronic Health Record), issuing electronic prescriptions and electronic transfers to Healthcare insurance institutions. OMA Emirates provides health cards that hold important information of the bearer including demographics, brief medical history, blood type, allergies and health insurance policy details that may save an individual's life. It can also act as an e-purse to allow bearers to pay for medical treatment.

E-INSURANCE

OMA Emirates' E-Insurance solution allows for all insurance procedures to be completed electronically including providing customers with policy information, allowing customers to complete and submit insurance claims as well as provide policy makers with audit guides. The E-Insurance cards hold important information for customers including basic medical information related to the bearer, insurance policy details and medical outlets covered under the insurance policy. Security is also ensured for both the policy makers and the customers with the integration of personal pin codes biometric based security mechanisms to avoid unlawful use of stolen or lost cards. E-insurance offers prompt and secure verification of entitlement based on prior configurations or set rules via a central, high-availability system.

TELECOM

E-REMITTANCE

OMA Emirates service provides you with peace of mind by minimizing paperwork and reducing the risk of error. E-remittance enables you to send your remittance contributions directly to us via our secure transactional Web site and even make payments using the account collection service available on most financial institutions' Web sites. Advantages of using E-remittance

- Makes managing your remittance payments easier

- Speeds up transmission of data

- Processes contributions to member accounts faster

E-VOUCHER

OMA Emirates Service is an easy solution to minimize paperwork and reduce the risk of error. E-remittance enables the user to send remittance contributions directly to via a secure transactional Web site and even make payments using the account collection service available on most financial institutions' Web sites. Advantages of using E-remittance

- Makes managing your remittance payments easier

- Speeds up transmission of data

- Processes contributions to member accounts faster

E-PAY

Electronic payments are payments that are made directly to payee from your bank accounts using security features over the Internet to process the transactions. Most financial institutions offer electronic payments online directly from their website to the payee. OMA Emirates' offers access to set up electronic bill payments through a financial software for easy payment and clear transaction.

M-PAY

M-Payment is emerging worldwide, moving payment lines and creating a new ecosystem for all merchants. OMA proposes ubiquitous white labeled enterprise level mobile agnostic solutions addressing all merchant needs:

- Full range of mobile acceptance devices with the highest market standards

- Long-standing expertise in local payment apps in more than 125 countries connected to more than 1,000 acquirers

- Providing mobility solutions to large retailers

- Payment secured solutions and EMV requirements everywhere

- Addressing new verticals such as deliveries

- Extending market to external contractor

- Mobile POS solution

- From card acceptance device to gateway

Mobile E-Top up Solution

OMA Emirates' Mobile E-Top Up Solution acts as an intermediary bentween service providers are retail outlets generating E-Vouchers with a 12 digit pin number for customers to instantly top up their credit balances or E-Top Up where the recharge amount is directly credited to a customers' phone followed by SMS Notification. The centralized processing service and integrated CRM solution manages each merchant and terminal and users are given advance reporting options with in-depth logs that provide accurate analyses of all prepaid activities. The unique multifunctional solution also manages e-ticketing, fund transfers, coupon generation, discount generation, gift card generation and prepaid card generation.

GOVERNMENT

EID

E-ID encompasses a large array of identity documents: national e-IDs, civil servants credentials, services cards, transit passes or even enterprises access cards. OMA Emirates' has structured our offering to fit the needs of four major segments: administrations and companies' internal uses, government offices, mobile solutions for public officials and personal solutions for citizen.

PARKING

Parking Solution

OMA Emirates along with digital payment solution partner (Ingenico) provides unattended terminals and payment applications for acceptance of cards as a mode of payment while parking. The solution offers quick and easy payment of parking fees with hardware and software that will allow payment through credit and debit cards. Read More